1 year later: Impact of GST exemption on Sanitary Napkins

Goods and Services Tax (GST) – launched at midnight on 1st July 2017, has been the talk of the nation ever since for various reasons. Though menstruation is still widely considered a social stigma, GST managed to gain a lot of attention for imposing a 12% tax on sanitary pads. Despite this being less by about 1.7% compared to the previously implied tax, many activists considered it as a detrimental factor to promoting menstrual hygiene. Primary rationale was that items like sindoor, bindi etc had been exempted from the tax system but sanitary napkins were not. Following the protests, on 21st July 2018 the Government announced that sanitary napkins would be completely exempted from GST.

It’s been almost a year since sanitary napkins earned the exemption from GST. It brought a cheer among people who had been protesting taxation during the past one year. But did it really bring the change that everyone hoped for?

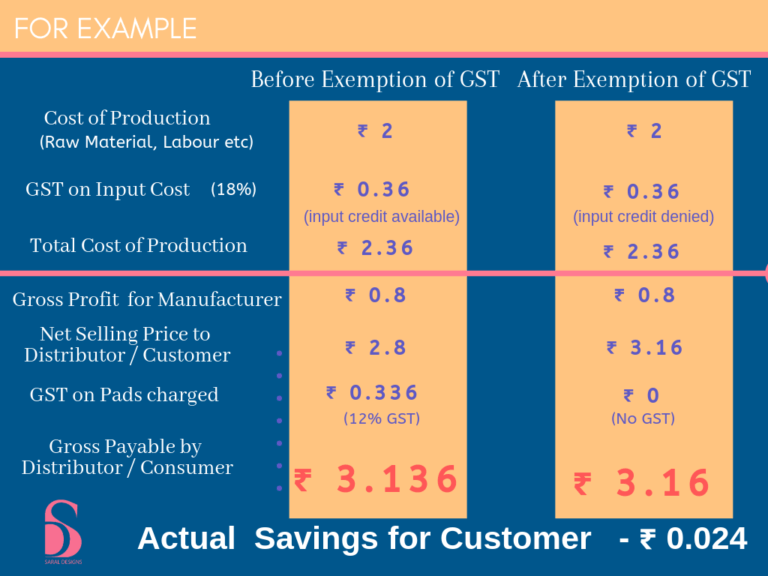

The GST exemption was perceived as a major victory and everyone was expecting a price drop. However, the benefit in the price of sanitary napkins for the consumer was very small.

Exemption of GST implies denial on input credit to manufacturers on raw materials. Since the GST on raw materials continues to be the same, in effect the overall price difference for the customer has been small. For example,

Before GST exemption:

If the cost of production of 1 pad is Rs 2.3, it has tax component of Rs 0.3 roughly (as GST on raw materials is 12% or 18%).

If the manufacturer’s selling price was Rs 2.8 + GST (@12%) i.e Rs 3.14 was paid by the distributor. In this case, the manufacturer was earning Rs 2.8 – Rs 2.3 – Rs 0.3 = 0.8 per pad as I was getting an input tax credit of 0.3.

After GST exemption:

Now, the manufacturer’s cost is still Rs 2.3 as there is no change in my Raw material GST rate and they do not get an input tax credit set off of Rs 0.3. To be able to earn the same margin of Rs 0.8, the selling price will now be Rs 3.10. So, for the customer there is only a saving of Rs 0.024 per pad or 24 paisa on a pack of 10 pads.

Alternatively, subjecting sanitary napkins to GST, at zero rate would allow the manufacturers to claim reimbursement on input tax. This in turn would have helped them to reduce the sanitary pads price and benefit to the consumer.

The menstrual hygiene situation across India is still in an unfortunately difficult condition. 25% girls in India remain absent in school during menstruation. Talking about menstruation is prohibited or considered a taboo is most households.

One policy change can impact the lives of millions and accelerate the years of work of NGOs, social enterprises, multinationals and many activists are relentlessly working in the menstrual hygiene space to solve for access, awareness and affordability.

7 Years at Saral Designs

Impact created by Saral Design by the Menstrual Health Management Project